The Tanzanian shilling (TZS) has strengthened against both the Kenyan shilling and the US dollar after months of depreciation earlier this year. Government measures, including a ban on the use of foreign currencies within its borders, played a key role in stabilizing the TZS.

Economist Daniel Kathali noted that the currency’s appreciation will bring significant benefits, though it could also reduce exporters’ earnings.Elijah Ntongai, an editor at TUKO.co.ke, has over four years of experience in financial, business, and technology research and reporting, offering insights into Kenyan, African, and global trends.The Tanzanian shilling (TZS) has made significant gains in recent months leading up to August.

The TZS has not only strengthened against East Africa’s strongest currency, the Kenyan shilling, but also against the US dollar. In April, the TZS had depreciated to one of the worst-performing currencies on the continent, trading at TZS 2,668 per US dollar.To curb the depreciation, the Tanzanian government implemented measures such as banning the use of foreign currencies domestically. As of August 27, 2025, the TZS had recovered to an indicative exchange rate of TZS 2,470 per US dollar, according to rates published by the Bank of Tanzania.

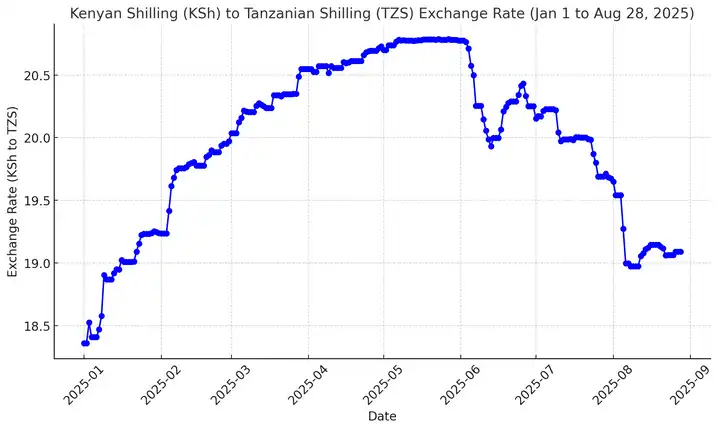

Kenyan Shilling vs. Tanzanian Shilling

The Tanzanian shilling has remained relatively stable against the Kenyan shilling. It reached its strongest exchange rate in January 2025, before falling to over TZS 20.5 per Kenyan shilling in May and June. The TZS recovered in July and August, trading at TZS 19.09 as of August 28, according to the Bank of Tanzania’s indicative rates.

Who Benefits From the Tanzanian Shilling’s Recovery?

Speaking to TUKO.co.ke, economist Daniel Kathali explained that a stronger local currency benefits importers and consumers who rely on imported goods.The bank of tanznia explains this through https://www.bot.go.tz/“When the Tanzanian shilling appreciates, importers, consumers, and businesses dependent on imported goods benefit because the cost of bringing in fuel, machinery, and household products becomes cheaper. This could allow Tanzania to lower fuel prices even further,” he said.

Kathali also noted that the appreciation has a downside: it may reduce the earnings of exporters and others receiving remittances in foreign currencies.

With its recovery, the Tanzanian shilling has gone from being the worst-performing currency to one of the most improved worldwide.Meanwhile, the Kenyan shilling has reached a 12-month high against major currencies, trading at KSh 129.24 per US dollar as of August 25, 2025.

Treasury CS John Mbadi described this as the currency’s “true value,” noting that it rebounded from a low of nearly KSh 165 per dollar in 2024 due to government efforts to manage debt and liabilities. He credited the shilling’s resilience to stronger forex reserves, which rose to 5.2 months of import cover from 3.8 months a year earlier, a 7.7% growth in exports, increased diaspora remittances, and early Eurobond repayments.

Tanzanian Shilling Recovers Strongly After Months of Weakness

The Tanzanian shilling (TZS) has staged an impressive comeback after months of heavy depreciation that had weighed on the country’s economy. Earlier this year, the local currency had slipped to worrying lows, raising concerns among businesses and ordinary citizens. In April 2025, the shilling traded at TZS 2,630 per US dollar and hovered around TZS 20.5 per Kenyan shilling, ranking among the weakest currencies in the region. Importers struggled with rising costs of fuel, machinery, and household goods, while ordinary Tanzanians felt the pressure of high prices on everyday commodities.

That trend, however, has shifted in recent weeks. As of August 28, 2025, the shilling strengthened remarkably to TZS 2,454.35 (buying) and TZS 2,478.89 (selling) against the US dollar, and TZS 18.96 (buying) and TZS 19.15 (selling) against the Kenyan shilling, according to the Bank of Tanzania’s indicative exchange rates. This recovery represents nearly a 7% improvement against the dollar and about 8% against the Kenyan currency, positioning the TZS among the most improved African currencies in 2025.

Economists attribute the rebound to government policies such as restricting the use of foreign currencies within domestic markets, which reduced speculation and stabilized demand for the shilling. For importers, the gains mean cheaper costs of bringing in fuel, machinery, and consumer goods, which could translate into lower pump prices and relief for households. On the other hand, exporters and recipients of foreign remittances may earn less in local terms, highlighting the double-edged nature of a stronger shilling.

From being one of the weakest performers just months ago to becoming a regional bright spot, the Tanzanian shilling’s turnaround marks a significant moment for the country’s economy—and a hopeful sign for consumers seeking relief from high living costs.